PALM COAST, Fla. – To be or not to be … in a recession?

That is the question on the minds of economists and members of the financial services industry as they look at what the rest of 2023 and 2024 may hold.

While keeping a close eye on international markets, the national debt, and consumer behavior – everything from jobs numbers and unemployment to spending habits as COVID cash runs out and middle-class America decides what to do next, financial experts say a myriad of factors are coming into play.

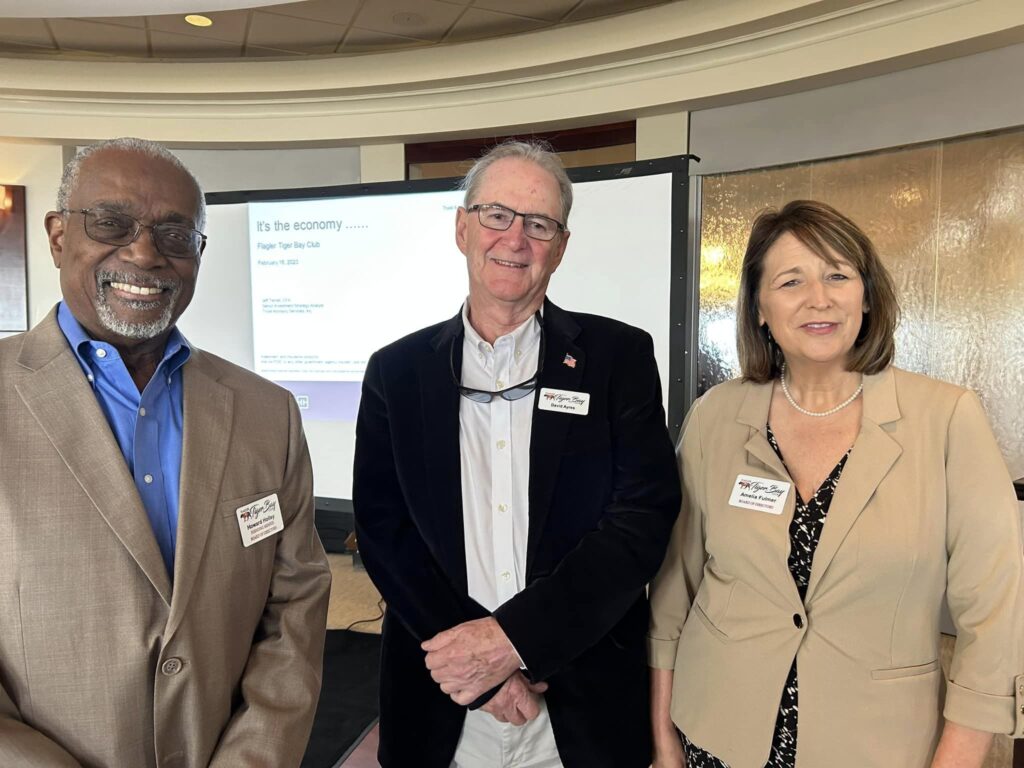

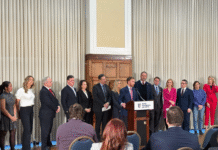

Members and guests of the Flagler Tiger Bay Club listened intently during the February meeting and luncheon as Truist Senior Vice President Jeff Terrell shared the company’s analysis of the global economy, mirroring points made by Federal Reserve Vice Chair Lael Brainard in a speech at the University of Chicago Booth School of Business in January 2023.

Touching on the impacts of the Federal Reserve’s tightening of policy in the U.S., the Russia/Ukraine war’s impact on the energy sector in Europe, International Monetary Fund trends, and the potential unfreezing of the Chinese economy post COVID, Terrell offered a snapshot of the next 12-18 months.

“This year we’re expecting about three percent global GDP growth, Bloomberg consensus is about two percent. We’re going to see most of this global growth is not U.S. based. It really is coming from places like India and expectations from China. Europe is actually doing better than anticipated but suffice to say we’re still in this environment of low single-digit growth,” he said, before discussing U.S. growth.

“We see that we’re somewhere between will we or won’t we have a recession? We’re in the camp right now we’re more likely than not to have a modest, shallow recession but it’s not imminent. There’s some reasons why it’s not imminent.”

“What’s common with the world right now is central bank policy has gone from ultra-accommodative pretty much from 2020. We had 18 trillion of global debt in the world with a negative yielding debt. That has largely been eliminated now, so now we’re in an environment where global central banks, Bank of Japan, Bank of England, the ECB are hiking rates, actually hiking them more than people thought they would just a few months ago, because growth is actually better and they’re trying to suppress it a little bit. One reason they’re doing that? There’s only one word. It’s Inflation. We’ve not seen inflation really since the early 80s at the level we’re seeing it now,” he said.

Speaking from more than 30 years of experience, Terrell refused to sensationalize the situation, instead choosing to put economic business cycles into perspective as he discussed strategies for managing inflation and a potential recession.

“History has context. Recession’s not a dirty word. Recession is a normal part of the business cycle,” he said. “Seems like a dirty word because until COVID we went 11 years without one.”

“Up until Lehman went bankrupt on September 15, 2008, the U.S. balance sheet with the Federal Reserve had never exceeded $800 billion. It quickly went through three strikes called quantitative easing, they did it three times, which tells me the first two times didn’t take. So, we went from this environment where we went from an $800 billion balance sheet for 50 years prior to the 2008-2009 recession, to $4 trillion. Just about time that was really being whittled down, COVID hit. And $4 trillion became $9 trillion.”

“The biggest impact of this is not just these numbers of $9 trillion, 8 trillion dollars, it sounds like funny money. But it’s a big difference when you go from large debt with a zero percent interest rate with zero percent interest rate policy, now we have short-term treasuries yielding closer to five and four-and-a-half. If you do that math, that’s somewhere between 300 and 400 billion dollars of debt service on that. This is something we haven’t looked at and been confronted with until the last 12 months, so there could be some lasting impact with that,” he said.

“What we’re seeing here is IF we have a recession, it’s likely to be short-lived, shallow. If we do not, we’re somewhere between a soft landing or maybe even no landing,”

The topic attracted a variety of attendees ranging from the district’s high school DECA clubs to business and retired executives, all interested in how the state of the national economy will impact Main Street USA.

“Jeff’s years of experience and vast knowledge of the financial markets was clear during his presentation at Thursday’s Flagler Tiger Bay Club luncheon,” said professional business coach and ‘Business Minds Coffee Chat’ national podcast host Jay Scherr.

“An excellent speaker, Jeff shared a wealth of information in an engaging way to help us better understand the economic outlook and where the opportunities are. This was a top-notch event and one that will be talked about for some time.”

“We’re all very interested in the economy and wondering about next steps,” said Flagler Tiger Bay Club Vice President Amelia Fulmer. “Jeff Terrell gave us a lot information on that and shared a lot of things we can take from here and feel more comfortable but also understand what the obstacles are in our economy.”

African American Entrepreneurs Association CEO Leslie Giscombe partners with Truist Bank to help provide educational programming for the minority community, and found the information presented important to those he serves in the business community.

“It was great returning to the Flagler Tiger Bay Club and seeing everyone since COVID,” shared Giscombe.

“It was an added honor to be able to have the opportunity to support Truist, who is a proud supporter of the AAEA Access to Capital Workshop Series. When community assets combine in impactful ways, the community always wins.”

Expressing his appreciation for the warm reception before heading back to North Carolina, Terrell shared a few thoughts for the future.

“I hope what people take away is that the economy is rapidly evolving. We’re in a very different time than we’ve ever seen before because adapting to COVID and adapting to life after COVID has been rewarding but offers some challenges I think we’re now dealing with,” said Terrell.

“I think we’ll always persevere. We’ve had good times and bad times before and continued to be successful. I don’t think now is any different. It might just look different.”